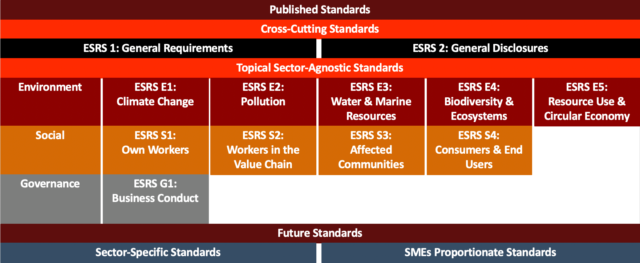

Overview of ESRS

On 31 July 2023, the European Commission confirmed the adoption of the European Sustainability Reporting Standards (ESRS). These standards are to be applied gradually from January 2024 by all companies that are subject to the Corporate Sustainability Reporting Directive (CSRD).

It is estimated that, in time, the CSRD will affect approximately 50,000 companies based on the following schedule:

- From 1 January 2024 (published in 2025): the CSRD will apply to companies that are already publishing sustainability statements and fall under the current Non-Financial Reporting Directive (NFRD), which includes listed companies that have in excess of 500 employees, EUR 40m turnover and/or EUR 20m balance sheet value.

- From 1 January 2025 (published in 2026): other European companies that meet two out of three criteria including having in excess of 250 employees, the turnover greater than EUR 40m and/or EUR 20m balance sheet value.

- From 1 January 2026 (published in 2027): SMEs (excluding microenterprises) that are listed on regulated markets. These companies are subject to lighter reporting requirements and may postpone their obligations by two years.

- From 1 January 2028 (filing for 2028 data): specific non-European companies that have European subsidiaries with European turnover greater than EUR 150m.

In addition, there are phase-in provisions that have been developed, including:

- During the first reporting year, companies are not obligated to report on anticipated financial effects from all climate and environmental-related impacts, risks and opportunities;

- For the first three years of reporting, the anticipated financial effects disclosures may be qualitative instead of quantitative; and

- For companies with fewer than 750 employees, ESRS E4 may be omitted for the first two reporting years.

Also, the transition plan for biodiversity and ecosystems under ESRS E4 is classified as a voluntary disclosure.

ESRS E4

ESRS E4 specifically addresses biodiversity and ecosystems and the related disclosure requirements. It is divided into six parts:

- General disclosure:

- ESRS E4-1: Transition plan on biodiversity and ecosystems

- Impact, risk and opportunity management:

- ESRS E4-2: Policies related to biodiversity and ecosystems

- ESRS E4-3: Actions and resources related to biodiversity and ecosystems

- Metrics and targets:

- ESRS E4-4: Targets related to biodiversity and ecosystems

- ESRS E4-5: Impact metrics related to biodiversity and ecosystems change

- ESRS E4-6: Potential financial effects from biodiversity and ecosystem-related impacts, risks and opportunities

Endangered Wildlife OÜ and ESRS E4

Endangered Wildlife OÜ and its partners are able to help companies navigate the ESRS reporting requirements and provide companies with the capability of meeting the ESRS E4 requirements ahead of schedule. Endangered Wildlife OÜ is able to develop the voluntary transition plan for biodiversity and ecosystems, and allow companies to already begin to quantify the financial effects disclosures ahead of the prescribed schedule.

The ESRS adjustments made by the EC, such as the voluntary disclosure nature of ESRS E4, has been criticised due to the urgency of needing to addressing biodiversity and to integrate biodiversity into business activities. For companies that are committed to upholding their biodiversity accountability, we can offer a best-in-class solution. Companies can achieve this status by actively recognising biodiversity and ecosystems within their business and reporting activities. These are standards that will be implemented across the EU and will align to the TNFD recommendations.